We wrote a comprehensive article earlier in the month on Uber’s entry into the Kenyan market which, as we broke down, has been anything but smooth sailing.

Last week, Uber announced during a press brief that anyone using their service in Kenya would be able to use cash. Apparently, Credit cards will also now not be required when registering to use the service. This wasn’t announced at the press conference or in their press release. They later informed their customers of this new development regarding credit cards via an email on Sunday 23rd August.

Using Uber in Kenya is now easier for a majority of Kenyans because they will be able to use and pay for the service without going the credit/debit card route. This was one of the biggest challenges that Uber was facing in Kenya as most Kenyans do not have credit cards.

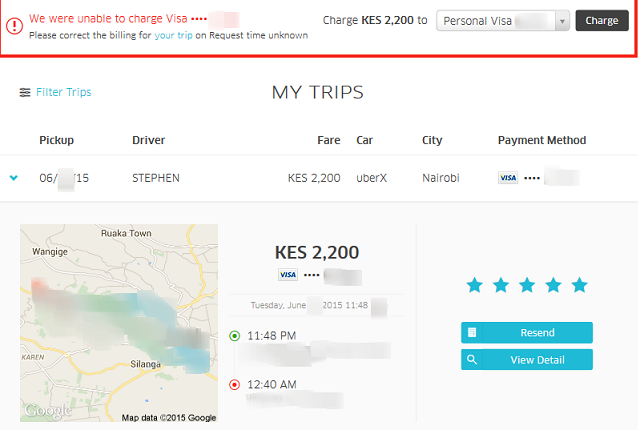

A problem that continues to persist however, is that there are Uber users who have debts and are unable to clear them. The debts arose from the fact that their (Uber users) cards were initially working on the Uber system but they ceased working at some point. These users are now unable to clear their balances despite wanting to because Uber is insisting that to do so they have to use a card. The pay by cash option does not apply or work as far as clearing debts are concerned.

I posed this issue to Mwambu Wanendeya, the Uber communications person for Africa, and his explanation was that he and the team in Nairobi are unaware of it and he didn’t have a ready answer on how to sort it.

To further compound the problem, technology blog Techweez has today reported that “Uber defaulters will be referred to the credit reference bureau (CRB) if they fail to settle their accounts. Defaulters can then be blacklisted and locked out of accessing credit facilities in future.” This means that Uber users in Kenya who have debts and are unable (but willing) to pay will be listed as defaulters and punished through no fault of their own.

Uber has crossed the hurdle of payments and registration for their service in Kenya but there is still a community that still needs attention and an immediate solution. Uber should facilitate and make it possible for these users to be able to pay through an alternative means. If users cannot walk to Uber offices to settle their outstanding bills, then Uber should perhaps register a Paybill number through which customers whose cards fail can pay via Mpesa.

Uber should also resist resorting to such punitive measures involving the Credit reference bureau before understanding why their customers are defaulting. At the time of publishing this article, we spoke to 10 uber users who have outstanding amounts that range from Ksh. 200 – Ksh. 2,500. That is hardly an amount to get blacklisted by the CRB for.