For the longest time, individuals intending to borrow had to walk to various financial institutions in order to compare their terms and rates. This used to be both tedious and time consuming not to mention to the numerous calls by sales executives trying to get you to sign the loan documents.

However, this is now a thing of the past with the launch of a Cost of Credit website by the Kenya Bankers Association (KBA) in collaboration with the Central Bank of Kenya. The site offers information on loan products together with their fees and charges. At the moment, the site is making comparisons on loan products for 34 lenders.

Initially the website will provide information on personal secured loans and mortgages with additional facilities being added with time. Once a customer logs in they will be able to search and compare the loans with favorable interest rates across the various banks. This will give a customer the ability to choose the lender with the best rates and terms. In my opinion this is a big win for customers because in the past banks were very secretive about some of this information in a bid to make a killing from unsuspecting customers.

It is actually pretty easy to use.

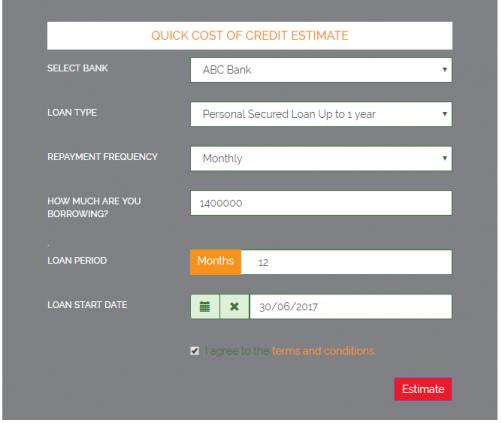

Step 1

Lets say you would like to borrow an amount of Ksh. 1.4 Million. You need to select the bank that you want to borrow from, the loan type and how long you would like to pay together with the loan start date. Agree on terms and conditions and click on estimate.

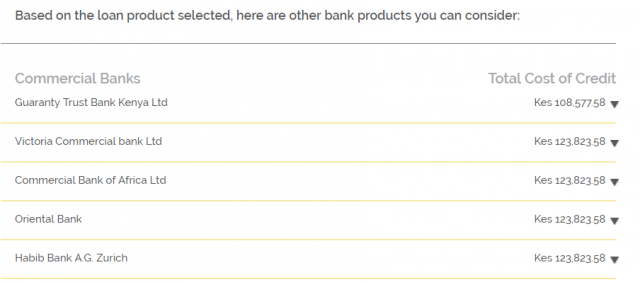

Step 2

The monthly repayment and the cost of credit is displayed. Since all banks have to use one interest rate, the total cost of credit is what makes a difference on how cheap or expensive a loan will be. In this case the Total Cost of Credit is Ksh. 139,224.

Step 3

One can be able to make a comparison with 5 other banks while looking for the best deal in town.

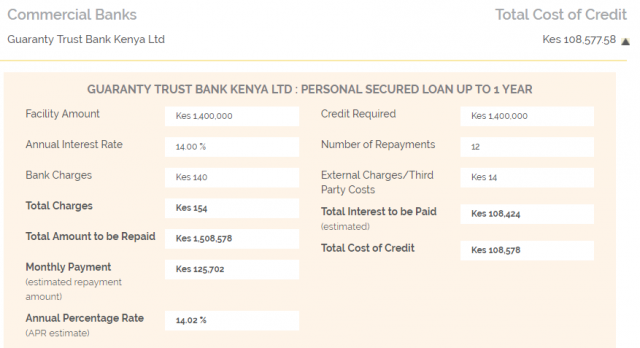

In this case, Guaranty Trust Bank Kenya Ltd has the best deal with its Total Cost of Credit being Ksh. 108,578.00 against ABC Bank’s Ksh. 139,224.00.

This makes Guaranty Trust Bank Kenya Ltd loan cheaper by Ksh. 30,646. However, the site also has a disclaimer that this is an approximation and not a binding contract and one should visit the bank for more details.